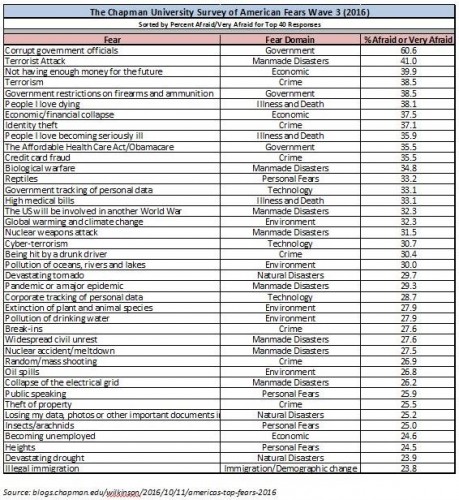

Everyone is afraid of something. It’s true. The visceral reaction to threats, real and imagined, has driven human behavior for millions of years. As time has passed, our species has evolved from fearing simple threats from predators and harsh climates to fearing more sophisticated threats. We have mostly conquered our ‘lizard brain.’ The lizard brain (so called because it is believed that reptiles survive almost solely on its impulses) is the amygdala, which controls emotions such as fear, our survival instincts, and memory. Controlling fear is how our ancestors emerged from the cave and conquered predators and darkness. Now, millennia later, what are we most afraid of? According to Chapman University’s 2016 ‘Survey of American Fears,’ Americans are most afraid of government corruption than any other of the additional 79 topics in the survey. That’s right: we are more afraid of our own government than we are of death, disease, loneliness, war, climate change, going bankrupt, snakes and public speaking. This year, it appears, we are also afraid of our future.

Some of our recent discussions with clients have surfaced their biggest fear: the outcome of our national elections on November 8. As we might expect, investors are worried about the future because of heightened dislike for many of the candidates and an uncertain future for the economy, the markets, and their portfolios. Their collective lizard brain says sell stocks and hide, much like our primitive ancestors, and emerge when the perceived threat has passed. As we often say, we understand this reaction. We know that the markets, like people, hate uncertainty. We also know that managing our emotions – especially conquering fear – in trying times is the key to success in any endeavor. So it is today.

Remember that the market has weathered many crises since 1900: two world wars, the Roaring ‘20s, the Great Depression, the first big market crash in 1929, oil shocks, wars in Korea, Vietnam and the Middle East, the 1987 flash crash, the Tech Bubble, high inflation, low inflation, terrorist attacks on U.S. soil, the Financial Crisis, a government debt downgrade, landing a man on the moon, the Ebola and Zika scares, ISIS, the beginnings of climate change, banking crises, the rise of the internet, the rise—and fall—of communism, and so on. Through all these events, capitalism has survived and adapted and moved forward. We believe it will again regardless of Tuesday’s election results.

Here’s our brief summary of the main issues to consider when thinking about the election and the post-election markets:

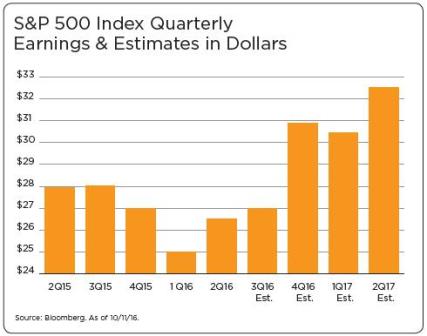

- The U.S. economy is chugging along in a low-growth/low-inflation environment. A recession is not on the IMMEDIATE horizon, interest-rate hikes are expected to be modest and drawn out, and the job and housing markets are stable. Preliminary Q3 GDP came in at +2.9%. As we write this, October’s payrolls number was good and included prior-month positive revisions, unemployment dropped to 4.9% and wages showed their highest year-over-year increase since 2009 (ending at +2.8%). Even market news is good: S&P 500 earnings results thus far for the third quarter of 2016 are showing improvement over the past six quarters. These data show expected improvement for the current quarter and into 2017.

- The Fed is expected to use the calm after the election storm to raise short-term rates by 0.25% in December, with two additional +0.25% hikes expected next year.

- The markets, and a narrow majority of the electorate, appear to favor the Democrat candidate. Mrs. Clinton has proffered a platform of change, but nothing that we see as too radical. We expect that, should she win and the U.S. Senate change control, that modest incremental legislation will be enacted to (among other things) change the tax code, work on regulatory and immigration reform and review U.S. trade pacts. The markets have, and should continue to, respond modestly.

- Many of our clients have stocks and bonds in their portfolios. The stocks are expected to provide long-term growth to keep ahead of inflation; the bonds provide income and act as ballast when markets are especially volatile and investors seek safety. Adjusting this mix by using rebalancing opportunities is our best tool to keep our strategic focus and avoid costly tactical mistakes. This is what we do.

Investors need to battle their lizard brains and keep their focus on the future, not the short term. The initial fear trade is to sell and go to cash; a tried and true short-term palliative, selling stocks and sitting in cash is good for short-term peace of mind but not a long-term planning strategy. Our clients know that we believe in globally diversified portfolios, that we focus on the long-term, and consider strategy over tactics to ensure that portfolios are built to stand the weather of time rather than simply avoid today’s storm.

As always, we appreciate your confidence and would be happy to discuss any of the issues raised here or answer any questions you may have.

economy election market volatility stock market us elections