The upcoming presidential election might have you worried about your investment portfolio. The good news is that past elections haven’t affected the stock market in a long-lasting way. But it can still be a good time to revisit your asset allocation and rebalance as needed.

Key takeaways:

- History shows that past presidential elections haven’t had a lasting impact on the stock market.

- Inflation and the economy are more likely to affect stock market returns, even if the same political party wins the White House and Congress.

- Sticking with your investment plan is recommended. The right financial advisor can help you strategize and rebalance your portfolio as needed.

Election years can be a tense time for investors. You might be worried about how the markets will react before, during and after an election cycle—and how that might affect your portfolio. Election outcomes have historically had a short-term effect on the stock market, regardless of which party is in power. That means sticking with your investment plan is usually the best path forward.

It’s also wise to diversify and rebalance your portfolio to make sure your asset allocation remains aligned with your financial goals and risk tolerance. An experienced financial advisor can be an invaluable resource. As we move through a new year, and an upcoming election, now is an ideal time to take stock of your finances and make a plan.

How Past Elections Have Affected the Stock Market

History has shown that past presidential elections haven’t had a lasting impact on the stock market. According to one U.S. Bank analysis, trends around inflation and the economy are more likely to affect stock market returns—even if one party sweeps both the White House and Congress.

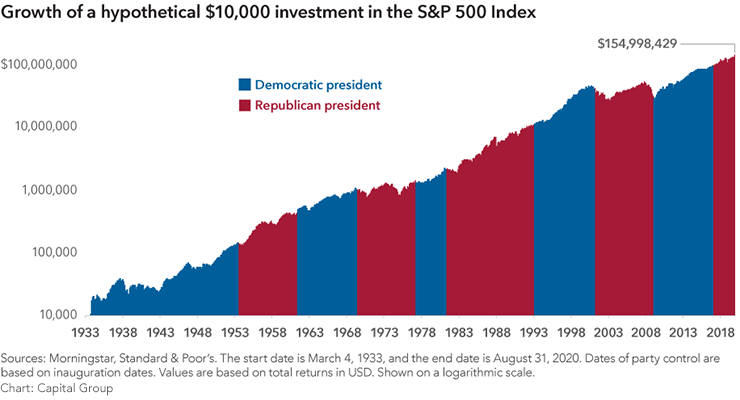

Political uncertainty can lead to short-term market volatility, but it isn’t wise to make investment decisions from this headspace. Veering away from your investment plan could cause you to miss out on future growth once the dust settles. The following chart shows how past presidential elections haven’t had the long-term stock market effects that many investors fear.

The Best Steps to Take During an Election Year

Times of uncertainty may cause temporarily hiccups in the stock market. Recessions are a great example. Stock prices tend to drop before and during a recession before eventually rebounding when things recover. Elections also have a way of disrupting markets, though on a much smaller scale. This is why it’s so important to stay true to your investment plan over the long term. Staying invested is the best way to position yourself for future growth.

That doesn’t have to mean doing nothing. Revising your asset allocation may be a smart move, especially if your retirement timeline or financial situation have changed. You want to be sure your portfolio still supports your long-term goals. That may involve taking on more equities than bonds, or vice versa. What matters most is staying diversified, which is the best defense against market risk—whether it’s an election year or not.

Looking Beyond the Election

The upcoming election isn’t the only thing to think about. Experiencing a major life change like marriage or divorce could also affect your short- and long-term financial plans. Below are some other important factors to consider:

- Inflation

- Economic uncertainty

- Concerns over the longevity of Social Security

- Battles over student loan payments

- Upcoming tax law changes

A financial advisor can provide personalized guidance that’s tailored to your needs. They can also help you stick with your financial plan and course-correct as needed, no matter what’s going on in the White House. At JJ Burns & Company, we’re proud to offer that to our clients. Contact us today to get started.