You’ve probably seen the news about the conflict between Israel and Hezbollah intensifying, which raises concerns about a wider war in the Middle East. Sadly, this is another chapter in an already unstable region. And this is all happening against a backdrop of ongoing global uncertainties like the Russia-Ukraine war, China-Taiwan tensions, unrest in the South China Sea, disruptions in the Red Sea, and the constant threats from North Korea and Iran. These are complex and tragic events with no easy solutions.

For many of you who have been with us for a long time, you may remember Operation Desert Storm in 1991, the early 2000s recession, and the War in Afghanistan, which began in 2001. Not to minimize any of those events, but this kind of cyclical unrest is something we’ve seen before and will likely continue to see. These geopolitical events will continue to affect financial markets for the foreseeable future, but the key is how we navigate through them.

How Geopolitical Risks Affect Your Investments

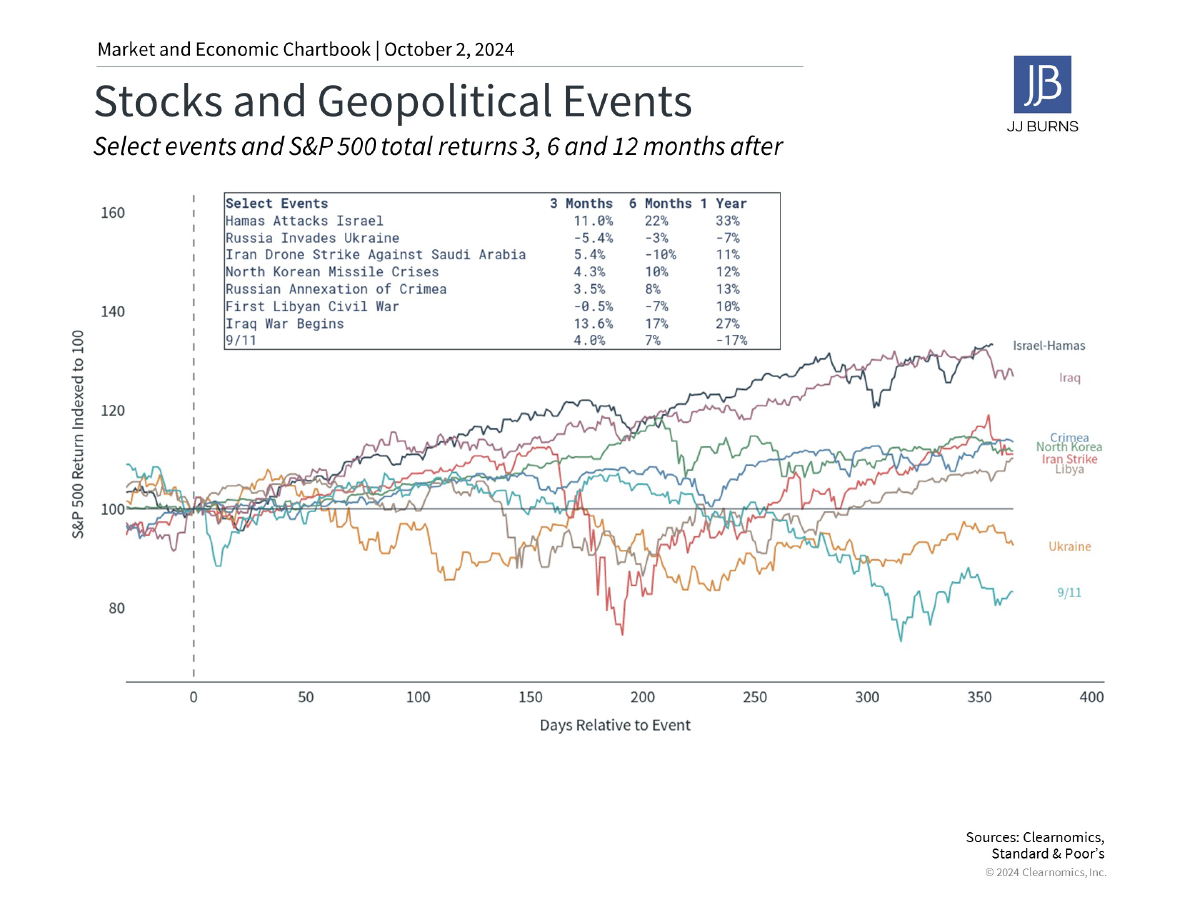

Of course, you might be wondering, how does all this affect my investments and the economy? History tells us that while geopolitical events often cause some market volatility and uncertainty in the short term, their impact tends to be temporary. Markets usually settle down as the situation evolves and stabilizes, and what really drives long-term performance are broader economic trends. That’s why it’s important not to make quick investment decisions based on headlines but to stay focused on your long-term goals.

As long-term investors, geopolitical risks are just part of the landscape. I get that it’s hard not to react to news that involves violence and loss of life. These stories hit much closer to home than typical business news about earnings, mergers, or market valuations. But from an investment perspective, it’s crucial to separate these emotions from your financial strategy.

History shows that market reactions to regional conflicts usually depend more on the overall economic environment than the conflicts themselves. If you look at past geopolitical events over the decades, markets often bounced back within a few days or weeks—if they were impacted at all.

When markets did struggle, it was often due to larger economic factors, like the dot-com bust during 9/11 or last year’s rapid Fed rate hikes coinciding with the start of the Russia-Ukraine war. On the flip side, many conflicts in the 2010s, like those in the Middle East or Russia’s annexation of Crimea, happened during times of economic expansion, which helped keep markets on track despite the uncertainty.

This was also true in the 20th century. We saw strong bull markets even with major global events like World War II, the Vietnam War, conflicts in the Middle East, and the Cold War, which cast a shadow over much of the century. The key takeaway here is that history doesn’t support making investment decisions based solely on geopolitics. The markets have shown resilience time and time again.

The Role of Oil Prices in the Global Economy

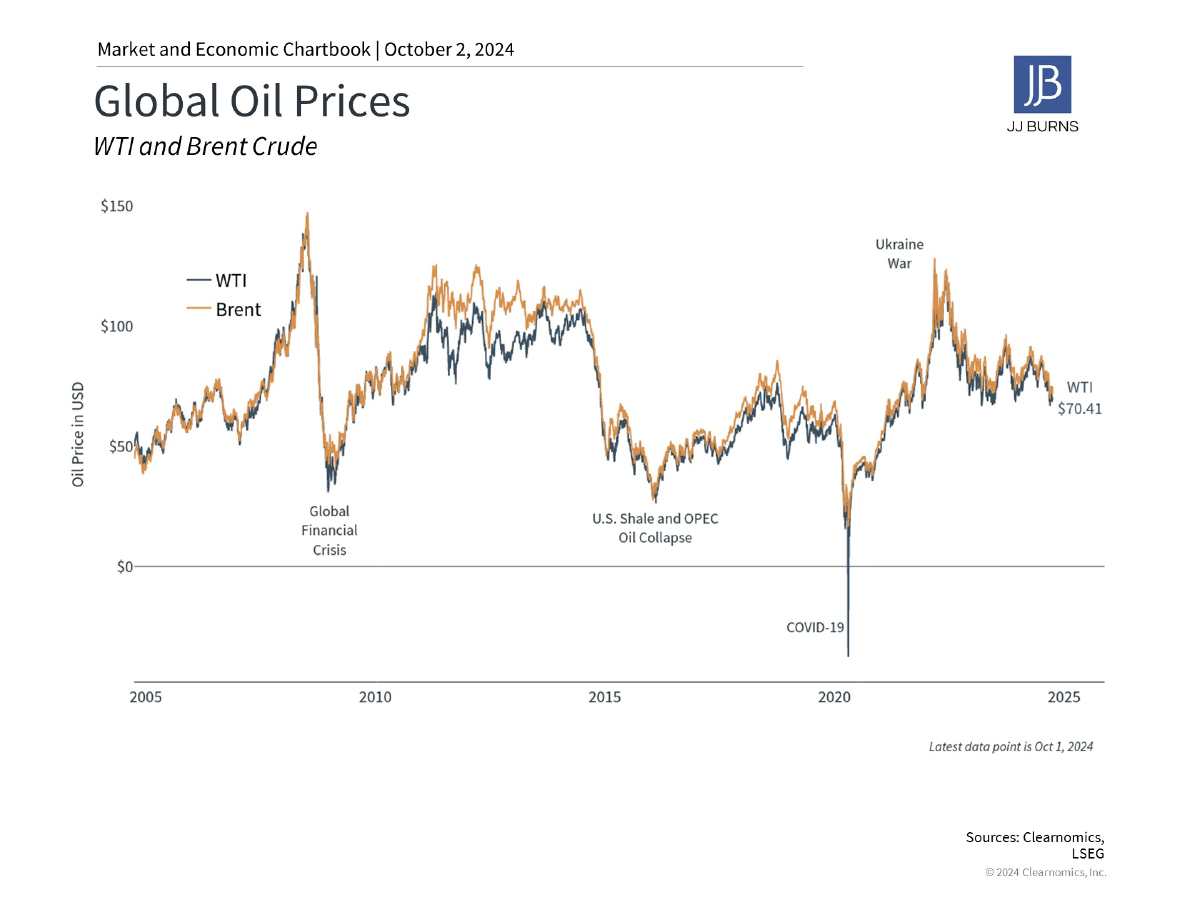

Now, short-term market disruptions usually come from rising oil prices or supply chain issues. For example, oil prices shot up during the early days of the Russia-Ukraine conflict, which worsened global inflation.

Right now, oil prices have ticked up slightly with everything going on in the Middle East. Brent crude is up from $69 to about $75 per barrel. But that’s a relatively modest increase compared to past spikes, like in 2022 when prices hit nearly $128 per barrel, driving U.S. gas prices above $5 per gallon.

One thing that’s different today is that the U.S. is the world’s largest producer of oil and gas, surpassing even Saudi Arabia and Russia. That’s one reason why the U.S. might be more insulated from global events than in the past, although we still rely on imports to some extent. Earlier this year, oil prices had a bigger influence on inflation and the Fed’s decisions, but now that inflation has cooled and the Fed has started cutting rates, the market seems less sensitive to short-term oil price changes.

Markets Are Resilient—But It’s Always Smart to Prepare for Uncertainty

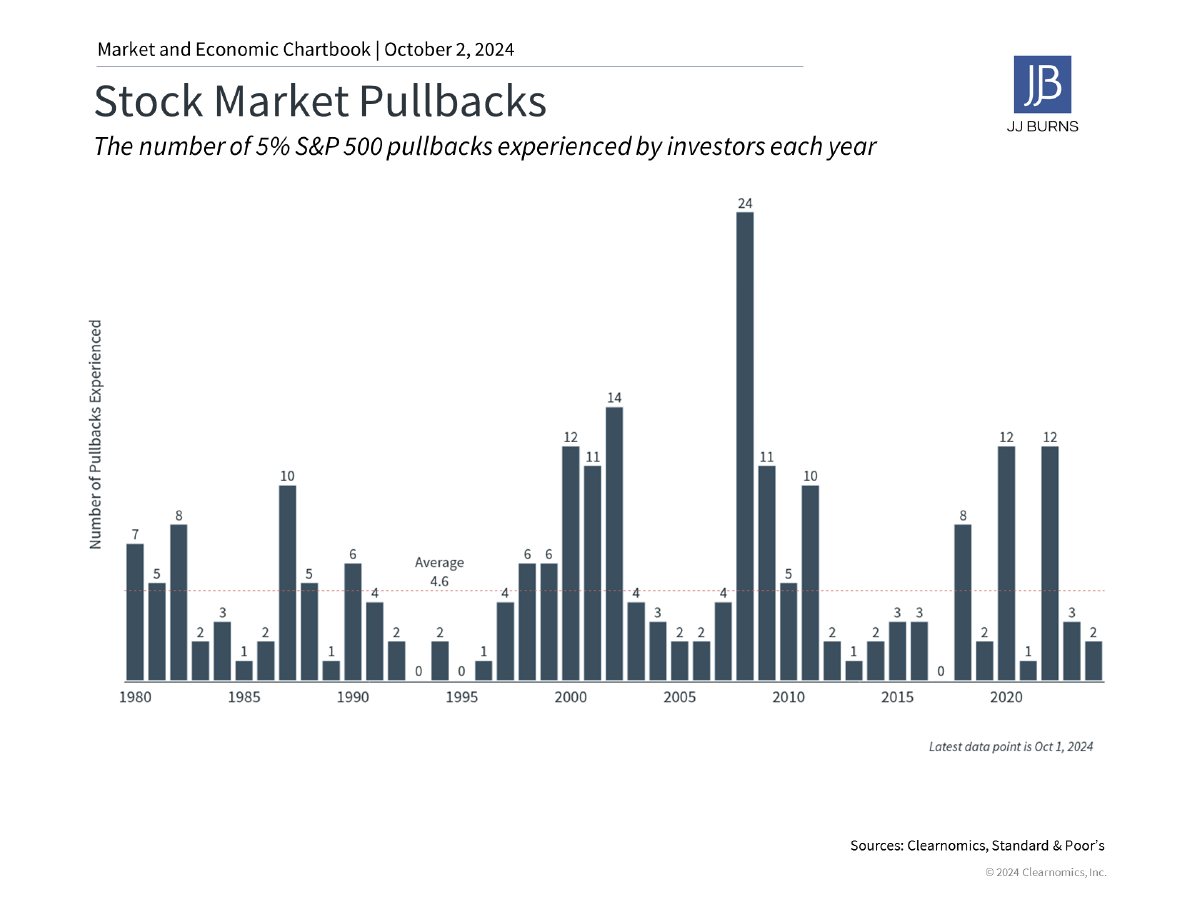

Even though it feels like there’s been a lot of uncertainty this year, the stock market has only experienced two 5% pullbacks—one in April and another in August, both tied to concerns about the Fed and economic growth. That’s actually below the historical average, especially considering that the S&P 500 is up 20.8% year-to-date. This shows why it’s important to stay invested and not overreact to headlines, while also being ready for market volatility.

When it comes to geopolitics, remember that while global stability is important, markets are primarily driven by broader trends in the economy and business cycles. So, while regional conflicts can increase uncertainty, history shows that making major changes to your portfolio based on these events is rarely a good idea.

What’s the Takeaway?

The situation in the Middle East is serious, no doubt about that, but it’s important to keep perspective when it comes to your investments. At JJ Burns & Company, we design your portfolio with long-term goals in mind—ones that can help weather periods of uncertainty. We’ll continue to monitor the situation closely and keep you updated if anything changes.

– Your Wealth Management Team at JJ Burns & Company

Disclosure: J.J. Burns & Company, LLC is a registered investment adviser with the U.S. Securities & Exchange Commission and maintains notice filings with the States of New York, Florida Pennsylvania, New Jersey, Connecticut, Georgia, Illinois, North Carolina, and California. J.J. Burns & Company, LLC only transacts business in states where it is properly registered, or excluded or exempted from registration. Follow-up and individualized responses to persons that involves either the effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or exclusion.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

The foregoing content reflects the opinions of J.J. Burns & Company, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.