As we all settle back into our post-Labor Day routines, it’s a great moment to pause, take stock of the markets, and maybe give our financial plans a quick check-up for the rest of the year. August threw us a curveball with some of the steepest market drops we’ve seen in two years, but thankfully, things have bounced back, and the S&P 500 is nearly at its all-time high again. With the Federal Reserve expected to announce a rate cut on September 18, interest rates have stabilized, and inflation is continuing to cool off. All in all, despite the usual September market jitters, there’s no need to panic.

Now, let’s talk about what all this recent volatility means for investors and what we can learn from it.

1. Expect Volatility – It Comes With the Territory

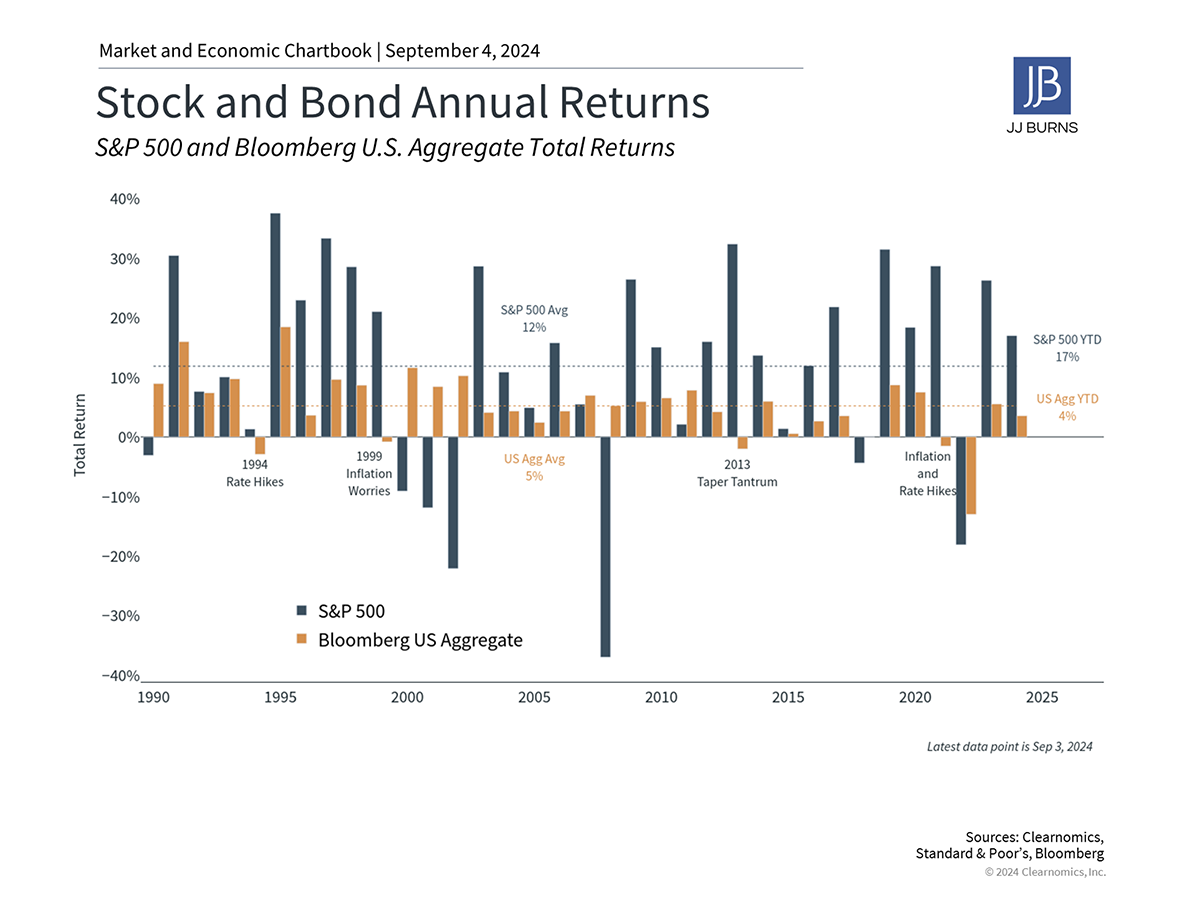

Markets have been a bit bumpy recently, but the numbers still look solid for the year. The S&P 500, Nasdaq, and Dow are all up by 19.5%, 18.6%, and 11.7%, respectively, when factoring in dividends. Sure, we’ve seen some pullbacks—there have only been two this year—but even the biggest one, at 8%, was below the historical average. Not bad considering how unpredictable things have felt!

Bonds haven’t had it easy either. They struggled for much of the year with rates staying high. But with the Fed signaling rate cuts, we’re starting to see some positive returns there too. This is a good reminder: Don’t let short-term events drive your decisions. Market swings happen. It’s all part of the game.

2. Fed Rate Cuts Are Coming – And That Changes Things

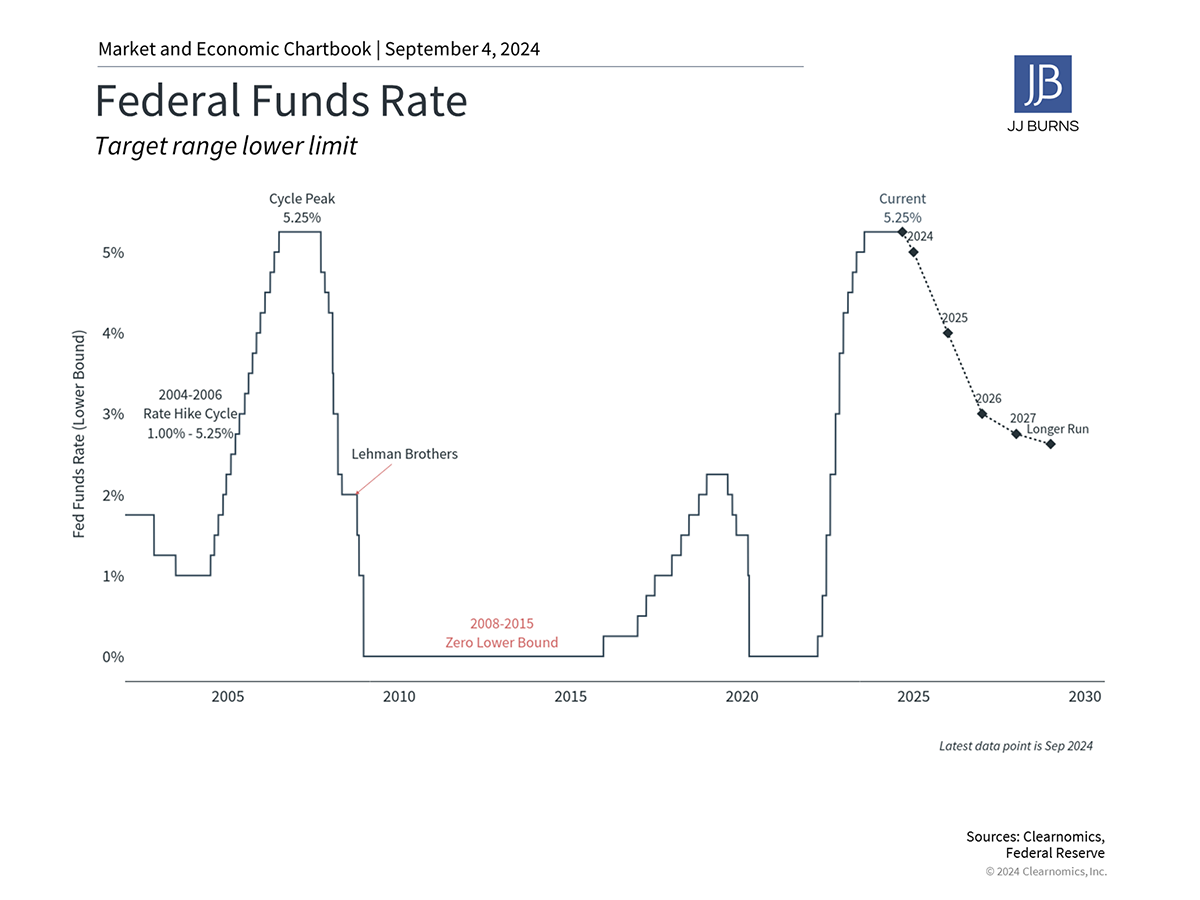

The Fed is likely cutting rates this month after an aggressive hike cycle from early 2022 through mid-2023. Why? Inflation is cooling down. Their go-to measure of inflation, the Personal Consumption Expenditures Price Index, has dropped to 2.5%, which is much more manageable. The Consumer Price Index is also lower, sitting at 2.9% year-over-year.

This year’s market volatility has been tied to shifting expectations around the Fed’s moves. First, there were fears of a “hard landing” and talk of rate cuts. Then, when inflation surprised us in the first quarter, people assumed no rate cuts would come. Now, we’re expecting about a 1% cut by year’s end. All these ups and downs are a reminder: Markets tend to overreact. Focusing on the bigger trends usually serves investors better.

Also, while the labor market is still in decent shape, it’s softening. Last month, we only added 114,000 jobs—way below the projected 175,000—and unemployment ticked up to 4.3%. Still, that’s not a crisis-level number, but it’s worth keeping an eye on. The Fed, after spending much of its energy on controlling inflation, is now turning its attention to the job market.

3. Lower Rates Could Be a Good Thing for Growth

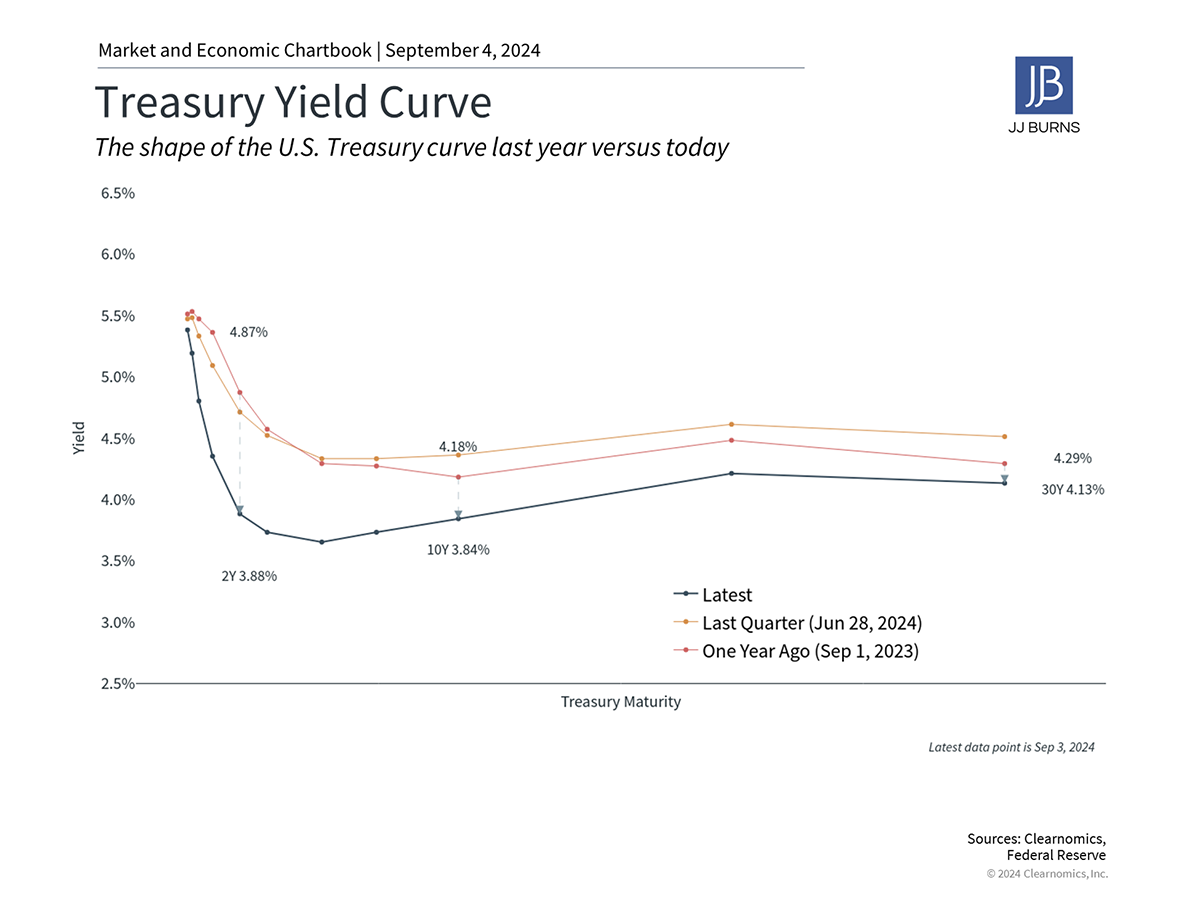

Interest rates have started adjusting as we head toward those expected Fed cuts. The yield curve, which was inverted (a potential warning sign for a recession), has now flattened out. This is a big deal because the inversion had some investors worried about a 2024 recession.

That said, lower rates could give a boost to economic growth, especially in sectors like real estate, tech, and small caps, which tend to be sensitive to rate changes. Bonds, too, have started to rebound as rates improve, making them a good portfolio diversifier once again.

The Bottom Line

How we respond to market swings is often more important than the swings themselves. The summer’s volatility is just another reminder to stay focused on the long term. Keeping your eyes on your financial goals, instead of getting caught up in the day-to-day noise, is key. If you have any questions, please feel free to reach out to us anytime.

– Your Wealth Management Team at JJ Burns & Company

Disclosure: J.J. Burns & Company, LLC is a registered investment adviser with the U.S. Securities & Exchange Commission and maintains notice filings with the States of New York, Florida Pennsylvania, New Jersey, Connecticut, Georgia, Illinois, North Carolina, and California. J.J. Burns & Company, LLC only transacts business in states where it is properly registered, or excluded or exempted from registration. Follow-up and individualized responses to persons that involves either the effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or exclusion.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

The foregoing content reflects the opinions of J.J. Burns & Company, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.