We’re happy to report on another very successful year in our shared journey toward achieving our clients’ most meaningful financial goals. As always, our strategy—both in planning and investing—remains firmly rooted in these goals, not in trying to predict the economy or the markets. This approach will continue to guide us in the coming year and beyond.

Let us start by revisiting some of the core beliefs that shape our work, and then we’ll share a few thoughts on the current financial and economic landscape.

General Principles:

- We focus on the long term. Everything we do is centered around your goals and driven by a carefully designed plan. We believe in investing in broadly diversified portfolios of high-quality businesses.

- We don’t believe in timing the market. Trying to forecast the economy or time the markets consistently just doesn’t work. Instead, we focus on capturing the long-term benefits of equity investing by staying the course—even during the inevitable ups and downs.

- We stick to the plan. As long as your goals remain the same, so does our approach. We don’t allow short-term market noise to dictate our decisions.

Market Commentary

So, what should investors look for in 2025? Will earnings growth persist? Additionally, what are the longer-term implications of interest rates — will the recent upward trend in rates continue?

There is much to discuss, so let’s take a few minutes to reflect on how we reached this point over the past year and what we can potentially anticipate in 2025.

2024 U.S. Equities Picture

For the most part, 2024 was a smooth ride for U.S. equities, with just a few bumps along the way. We saw some brief volatility tied to concerns about the Japanese Yen, slower summer economic growth, and a December shake-up after the Fed struck a less rate-cut-friendly tone for 2025.

Even with these moments of uncertainty, 2024 turned out to be another fantastic year for long-term equity investors. The S&P 500 gained 23.31%, the Nasdaq 100 soared 24.88%, and the Dow Jones Industrial Average rose 12.88%.

Artificial intelligence (AI) was a big driver of market excitement in 2024, proving it’s a technology with game-changing potential. As we head into 2025, though, it’s worth keeping an eye on how global competition—especially from emerging Chinese players—might shake things up and influence AI’s direction.

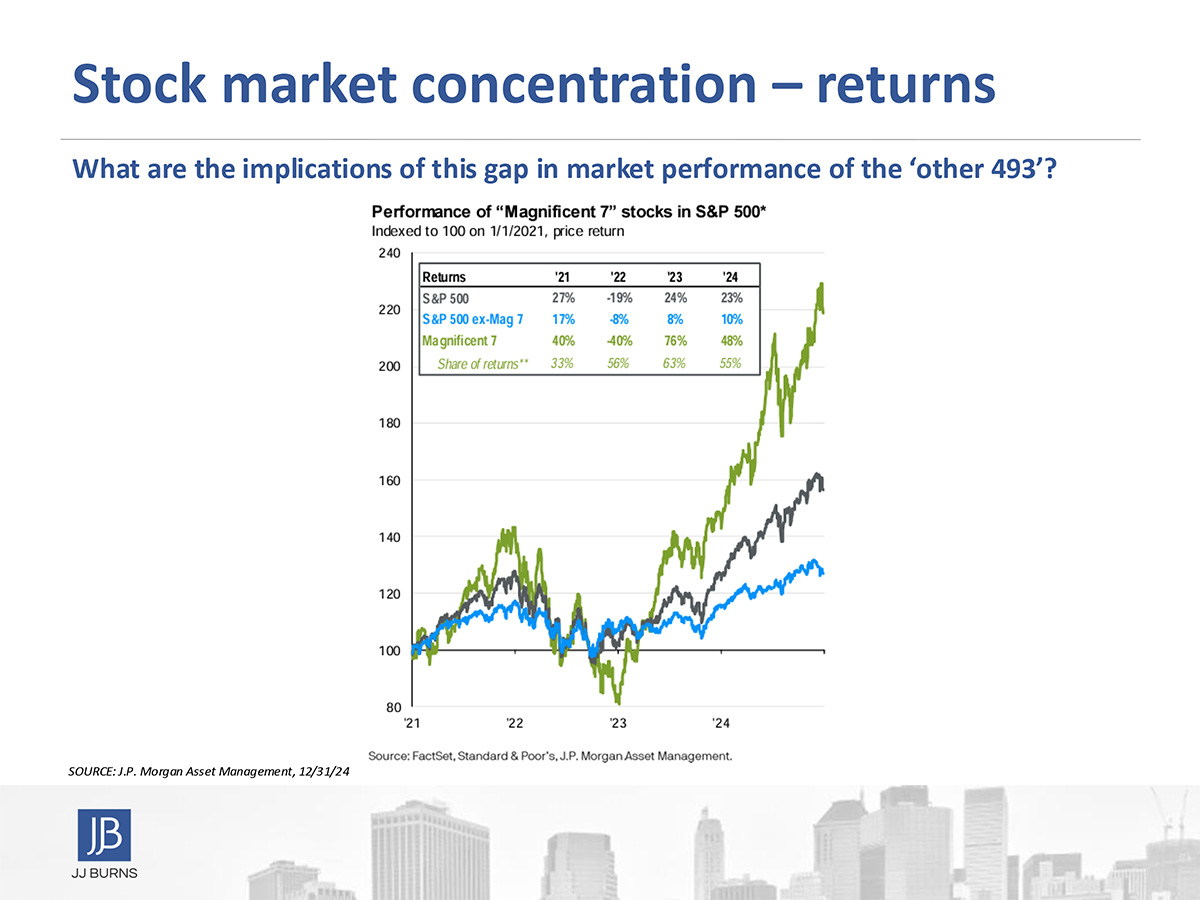

2024: Magnificent 7 Rally, Further Broadening in 2025?

Once again, the Magnificent 7 stocks dominated in 2024, with all seven delivering impressive gains. NVIDIA, in particular, stole the show, continuing to attract massive investor interest over the past couple of years.

These powerhouse stocks contributed 57% of the S&P 500’s gains this year, down slightly from 65% in 2023. While the market’s overall returns were impressive, the other 493 stocks in the index delivered single-digit gains without the influence of these seven giants. That said, we did see a bit of broadening, which is encouraging.

So, what about 2025? Could we finally see leadership spread out more evenly? A broader rally might help sustain market momentum, albeit more moderately, especially with valuations sitting on the higher side. But if that happens, will the big names come back to earth?

Of course, no one has a crystal ball, and that’s why staying diversified is key. It’s the best way to navigate whatever the markets throw our way.

Long-Term Effects

The past two years have been incredible for U.S. stock indexes, with the S&P 500 delivering its best two-year stretch since 1998—an amazing reward for long-term investors who stayed the course.

Despite all the headlines, from interest rate swings to elections, sticking to a disciplined approach has paid off once again for those focused on the long term.

As we dive into 2025, let’s keep that steady mindset. Staying balanced and avoiding overconcentration in the “hot” trends will be key. Yes, discipline remains our favorite mantra!

Consumer Inflation

In 2024, consumer inflation declined overall, helping trigger recent rate cuts. However, the path to the Fed’s 2% target remains slow, with inflation proving sticky toward the year’s end.

Shelter prices have been stubborn but are showing early signs of accelerating at a slower pace. Gasoline prices have dropped steadily in recent months, partly due to new production permits under the new President.

Core CPI, which excludes volatile items like energy and food, rose 3.3% in November, signaling that while inflation has eased, it’s still a challenge.

In short, inflation showed progress in 2024, but the final stretch to the Fed’s target remains tough.

Labor Market

The U.S. labor market in 2024 was resilient, with moderate hiring and a 4.2% unemployment rate by year-end. However, the labor force participation rate remains below pre-pandemic levels, highlighting an ongoing labor shortage.

Looking ahead to 2025, economists are divided, but many expect continued resilience with a potential soft landing.

U.S. Consumer

U.S. consumer resilience continues to impress!

Commodity prices measured by the S&P Goldman Sachs Commodity Index, were slightly higher overall, though some items, like coffee and eggs, saw notable price hikes. Looks like pricey breakfasts are back!

Consumer confidence spiked ahead of the presidential election, but December data showed a sharp drop, bringing it back to the middle of its two-year range. The final 2024 reading fell short of expectations. Will this trend continue into 2025 with the current economic backdrop? Only time will tell.

Fed Tone Shift / Outlook

U.S. equity indexes saw strong gains in 2024 as expected rate cuts became a reality. However, at the December meeting, the Fed adjusted its 2025 rate cut outlook, reducing the forecast from four cuts to two.

Now, markets will be watching closely for positive inflation (and jobs) data to fuel hopes for further rate cuts. Meanwhile, there’s a chance the concentrated rally of 2024 could start to broaden.

Let’s not forget that at the start of 2024, markets had priced in 6-7 rate cuts, though the Fed had signaled only three. In the end, we got the expected number of cuts, with one being a larger-than-anticipated 50-basis-point reduction.

Could the Fed take similar action in 2025? Some financial food for thought!

The Takeaway

2024 was another great year for U.S. equities, rewarding disciplined, strategic long-term investors for the second year in a row. As we head into 2025, the inflation outlook is still uncertain, with some sticky areas remaining. This led the Fed to lower its expected rate cuts for 2025, which initially disappointed market bulls, though sentiment improved afterward.

The labor market, while cooling, remains resilient, which is a positive sign for the year ahead. New trends and data will undoubtedly emerge, shaping the economic landscape.

As always, we encourage our clients to stay focused on their long-term goals and follow their plan. Portfolio structure should align with needs, not short-term market movements. We’ll continue to prioritize growth and income for the long run, keeping in mind potential volatility as we move into 2025 with a new administration and evolving policies.

We want to wish you health, happiness, and continued prosperity in 2025. If you have any questions, please don’t hesitate to reach out to us.

– Your Wealth Management Team at JJ Burns & Company

Disclosure: J.J. Burns & Company, LLC is a registered investment adviser with the U.S. Securities & Exchange Commission and maintains notice filings with the States of New York, Florida Pennsylvania, New Jersey, Connecticut, Georgia, Illinois, North Carolina, and California. J.J. Burns & Company, LLC only transacts business in states where it is properly registered, or excluded or exempted from registration. Follow-up and individualized responses to persons that involves either the effecting or attempting to effect transactions in securities, or the rendering of personalized investment advice for compensation, as the case may be, will not be made absent compliance with state investment adviser and investment adviser representative registration requirements, or an applicable exemption or exclusion.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful.

The foregoing content reflects the opinions of J.J. Burns & Company, LLC and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful.