The coronavirus is continuing to make headlines as more and more new cases are documented. Panic hit a fever pitch this week when news broke that the virus is no longer contained to China. There are now reports of confirmed cases in at least 47 countries, including one case in the United States.

It’s something that’s obviously having a global impact. And, not surprisingly, equity markets are reacting in kind. The Dow Jones Industrial Average has fallen by over 11% so far this week. The S&P 500 and the Nasdaq are reflecting similar activity.

In a nutshell, it’s been a rough week for stocks, and investors are understandably rattled. But as fear takes hold, we encourage you to press pause and take a deep breath before selling off chunks of your portfolio for safer, lower-yield investments.

The Stock Market Has Historically Rebounded Following Downturns

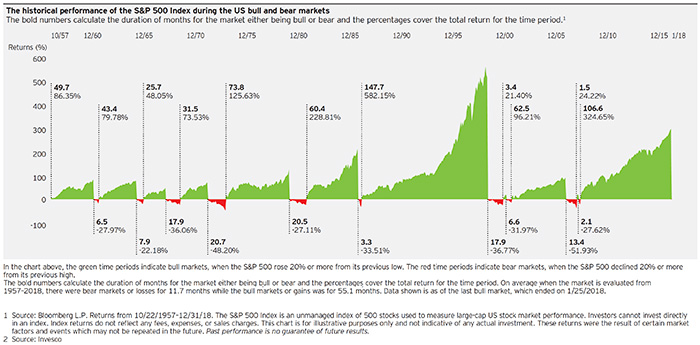

Let’s start by looking back on historic market activity. If you zoom out and look at the big picture over the last several decades, the market historically has a way of rebounding after a low period—even extraordinarily low periods.

Investors panicked during the 2008 housing crisis and into the Great Recession. The market was in terrible shape, and fear jumped into the driver’s seat. However, those who tuned out the noise, stayed the course and stuck with their investment plan over the long haul reaped the benefits once the market inevitably found its footing again.

Let’s look again to the end of 2018. Investors faced a less-than-encouraging outlook, only to see the market rebound after the Fed decided to put rate hikes on hold. The market is extremely volatile by nature, and a number of influencing factors can move it one way or another; whether that’s a trade war, global political upheaval or, yes, even a frightening epidemic. It’s the long view—rather than what’s happening most recently—that’s the best predictor of how things will ultimately unfold.

Don’t Let the Coronavirus Turn Your Portfolio Upside Down

With that said, staying invested and ignoring the pandemonium is easier said than done. But remember, a strong long-term investing plan is one that accounts for market ups and downs; even extreme ones. Pulling out and relying heavily on cash, for example, may feel safer, but you’ll likely be robbing yourself of future returns once the dust settles and things balance out again. You have to ask yourself how this kind of knee-jerk reaction will ultimately impact your long-term financial goals.

During times of uncertainty and fear, it’s human nature to want to do something. Staying still can feel like inaction, but when it comes to investing, the opposite is true. Often times, the smartest thing you can do is sit tight and ride it out.

This can feel agonizing if your retirement years are in the near future, but each portfolio created for our clients is based on a well-thought-out, written plan. We don’t have a crystal ball, so our planning and investing philosophy is based on a simple premise: focus on the things you CAN control so you can best prepare for the things you can’t.

- We make sure your portfolio is based on YOUR goals and time horizon.

- We ensure your portfolio is diversified across and within asset classes, as appropriate to meet your long-term goals.

- We periodically rebalance portfolios to your optimal targets when it’s appropriate.

Don’t Be Afraid to Lean on Your Financial Planning Team

As we well know by this point, the media has a habit of sensationalizing big news stories. The coronavirus is no different. If an outbreak indeed happens, more market volatility may be in store. However, it’s our view that the virus will ultimately be contained.

Again, everybody’s investment needs and retirement timelines are different. The right team can help you bring the bigger picture into focus so you can invest in a way that brings you closer to achieving your long-term goals. At JJ Burns & Company, we specialize in helping you feel confident and secure in your investment strategies—no matter how the market reacts to global crises. We’ve got your back, every step of the way.