Investors and consumers alike are understandably interested in the ups and downs of interest rate cycles. The Federal Reserve, in addition to managing U.S. monetary policies, apparently has a new hobby: art.

Investors are focusing on the Fed’s “dot plots,” which are forecasts for the central bank’s key interest rates. The dots seem to be going up, indicating that Fed officials predict the interest rate will be rising in the coming years. Here’s how it currently looks:

Researching Beyond the Dots

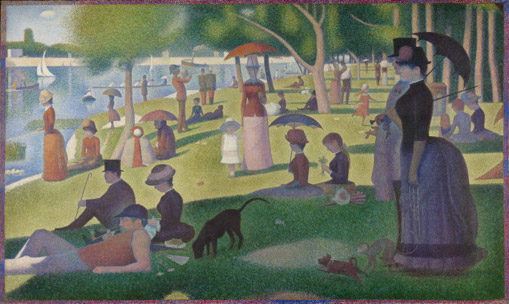

At JJ Burns & Company, we take the fact that the Fed’s rather simplistic dot plot has become a focus point for investors with a bit of a grain of salt. An oft-repeated axiom is that the markets like certainty, despite the fact that we live in an uncertain world. So we’d like to suggest the Fed provides us with a more detailed dot plot that may look something like this:

Georges Seurat, and his fellow Pointillist artists, composed their works with thousands of dots or very fine brushstrokes. The artists would carefully blend many dots to create images that become clearer as the viewer steped back to look at the complete work.

Investors may want to take a page from the Pointillist approach into their individual investing strategy—considering the range of economic data, such as inflation (or deflation), GDP and employment statistics—and looking at the bigger picture in making their financial decisions.

So while the possibility of rising interest rates can be unsettling at times, they can also bring on positive projections. These include:

- Higher nominal rates on fixed-income instruments, particular shorter-term paper

- Generally stronger economic activity

- Better earning environments for financial institutions as loan volume and rates increase

- Potentially stronger equity market returns

Acting on Varying Interest Rates

Overall, the Fed is still being cautious about hiking interest rates. The Fed appears to be committed to a slow and measured increase in the cycles, with the intent to raise interest rates to a level where they will be able to lower rates again to stimulate the economy. They must also take into consideration the impact of pushing the dollar’s strength higher in an environment where many other central banks are pursuing expansionary policies, as that may negatively impact revenues and earnings for U.S. stocks.

Almost certainly, stock and bond volatility will be higher given the many swirling headwinds and tailwinds in the current global economy. We believe that past correlations between stocks and bonds (specifically with relation to credit spreads) will hold despite the low rate environment, and that the Fed rate increases will be quickly absorbed by the markets.

Making Investment Decisions

All of these events mean that investors may find themselves in difficult places. The Fed’s various stimulus programs (QE and Operation Twist) have helped reflate asset prices pummeled during the financial crisis. However, a lighter touch may have led to fewer rounds of QE or a modest rate hike earlier in this recovery, when more data pointed to less precarious circumstances.

Planning for the Future

Whether you make decisions based on dot plans or choose to step back, it’s important to gather key information and look at the bigger picture. JJ Burns & Company can help you connect the dots with a financial plan that addresses your—and your family’s—needs. Learn more about how we can work with you to plan for your financial future.

federal reserve interest rates